Paul Krugman on Trump's economic house of cards

"The thing that’s extra damaging now is the craziness."

Public Notice is reader funded. Support us by becoming a paid subscriber 👇

🗣️🎙️ Tune in this afternoon to Nir & Rupar, featuring the great Joe Sudbay as guest co-host, at the special time of 3pm eastern. Click here to watch as soon as we go live on the Substack app 🗣️🎙️

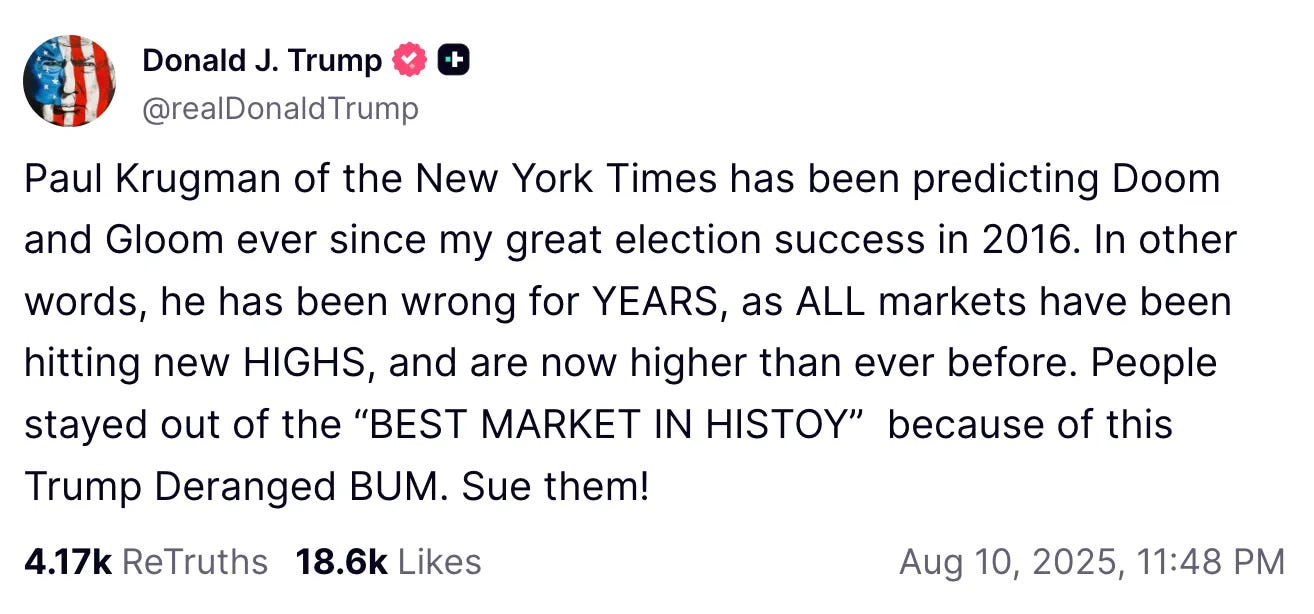

Paul Krugman’s publication here on Substack has quickly become a vital resource for explanatory (and entertaining) coverage of Trump’s self-destructive economic policies. In fact, the Nobel Prize winner recently triggered Trump himself, with the president howling that Krugman is a “Trump Deranged BUM” in an unhinged Truth Social screed.

So with economic indicators weakening and talk of stagflation in the air, we connected with Krugman for a wide-ranging conversation about tariffs, inflation, why the AI bubble is reminiscent of the late 1990s, Trump’s teetering economy, and more.

“I think there’s a high likelihood of what we used to call a ‘growth recession’ or a jobless recovery — a situation where the economy isn’t plunging, but in fact unemployment is going up,” Krugman told us. “The economy is growing too slowly right now to generate enough jobs and there’s real weakness, which we’ve already seen in the data.”

“The thing that’s extra damaging now is the craziness. Nobody knows what the tariff rates will be in six months. Businesses making investment decisions want to know what things are going to be like over the next five years, but nobody has the faintest idea.”

A transcript of the conversation between Krugman and Public Notice contributor Thor Benson, lightly edited for length and clarity, follows.

Thor Benson

Why haven’t tariffs inflicted more damage on the economy already? There were a lot of dire warnings in the lead up to Trump’s “Liberation Day” announcement nearly five months ago.

Paul Krugman

The scale of Trump’s tariffs is beyond the highest expectations people had. When he was talking about 10 percent tariffs globally, people thought, “Well, he won't really do that.” In fact, it looks like we're going to end up with an average tariff rate of around 18 percent, which is huge. We knew the reaction would be delayed, and it’s been even more delayed than expected, but it’s starting to show now.

The first thing to say is that, in general, protectionism is bad, but people tend to overstate the case. I've written about that a few times. It sounds important, because it has global effects, but it gets overhyped. Our screwed-up healthcare system does way more damage to the economy than Trump’s tariffs. Reasonable estimates of the long-run impact of these tariffs is a 0.4 or 0.5 percent cut to GDP — not trivial, but not apocalyptic.

In terms of the inflationary impacts of tariffs, there was a lot of front-running. Companies that import stuff rushed to do so earlier this year before the tariffs kicked in. To some extent, we're still living off inventory that was built up in that period, and you can see it in the data. There was a huge surge in imports early in the year and then a huge drop after the tariffs finally kicked in. We're still living off inventory that was brought in at much lower tariff rates.

It’s also important to note that the TACO thing is wrong. Trump did not chicken out. We've got 15 percent tariffs on the EU and Japan and iron tariffs on a number of countries.

The fact that people kept thinking we were gonna have trade deals and the tariffs were going to come back down meant that companies were reluctant to pass price hikes into stores, because they didn't want to make customers mad and lose market share. It's only now really sinking in that this is for real, and so the “let's eat the tariffs for a while” thing is fading out.

It's happening a little slower than expected, but for the most part we're pretty much right in line with what economists were saying earlier this year.

Thor Benson